How IMT Uses AI to Automate Insurance and Guarantee Processing for Swiss Insurer

Why Speed Matters in Swiss Healthcare Insurance

In a market regarded as one of the most developed in healthcare and insurance like Switzerland, delays in response – even just a few minutes at the reception desk – can directly impact customer satisfaction and loyalty. According to a survey by Moneyland in 2024, processing speed and transparency are the two most important factors determining satisfaction with insurance companies. Meanwhile, the discrepancy between companies in terms of returning documents and processing claims is quite significant:

Delays in insurance response times can lead to several negative consequences across the healthcare journey. Patients are often forced to wait longer at medical facilities, which causes stress, discomfort, and gradually erodes their trust in the insurance provider. At the same time, healthcare facilities struggle to coordinate effectively, resulting in disruptions to care delivery. Furthermore, Third Party Administrators (TPAs) can become overwhelmed by accumulating requests, especially during peak hours, which increases the risk of operational errors and further delays across the system. Conversely, insurance companies that handle claims quickly and transparently tend to outperform competitors in customer satisfaction. Their responsiveness not only earns them higher ratings in satisfaction surveys, but also helps build lasting trust – leading to significantly higher customer retention rates.

Swiss Market Context: High Competition – Stringent Customer Expectations – Strict Security Standards

Switzerland is one of the most developed and competitive insurance markets in Europe. With a high-quality healthcare system, a variety of insurance providers, and customers with high expectations, insurance companies in Switzerland are forced to:

- Accelerate the processing of requests – especially in outpatient fee guarantees

- Enhance user experience at touchpoints such as clinics and hospitals

- Comply with strict data regulations: FADP (Swiss Data Protection Act), GDPR, and internal financial industry standards

- Integrate automated e-payment solutions between insurers and medical facilities to minimize manual invoicing delays (as highlighted in the AI-enhanced “Guarantee Plan” phase)

- Ensure that claim approvals, financial verification, and disbursement happen in near real-time to reduce hospital wait times for insured patients

However, many Third Party Administrator (TPA) systems still face critical inefficiencies in handling benefits assessment and real-time guarantee planning – often relying on manual, disconnected processes. These limitations reduce responsiveness, delay claim approvals, and negatively affect both healthcare providers and customer satisfaction

Overview of the Outpatient Fee Guarantee Process in the TPA System

The insurance process involves three main parties:

- The insured person – presents documents

- Medical Facility – examines and submits treatment costs

- TPA (Insurance Processor) – assesses and plans the guarantee

Although the initial verification steps are quick (~5 minutes), the two subsequent ones normally take the most time:

Step |

Time to Process |

|---|---|

| 1. Assessing medical requests | ~5 minutes |

| 2. Planning the guarantee | ~25 minutes |

| Total | ~30 minutes |

Consequences:

Patients using on-site insurance guarantees often face long delays, as the confirmation process alone can take up to 30 minutes – not including medical examination time. As a result, total wait time can stretch beyond 45 minutes, leaving already unwell patients feeling frustrated and fatigued. During peak hours, TPA units become overwhelmed, increasing the risk of errors such as approving the wrong benefit, rejecting valid claims, or missing key policy details. These inconsistencies not only damage customer trust but also affect the company’s reputation. Over time, prolonged feedback cycles and poor hospital experiences reduce the perceived value of the insurance service itself.

The Issue in Switzerland: Demand for Fast Processing While Maintaining Absolute Security

- Insurance companies in Switzerland face a triple challenge

- Accelerate processing time without causing errors or bottlenecks

- Ensure full security for medical data, contracts, and payment processes

- Maintain a consistently high standard of service – precision, reliability, and clarity, in line with the country’s renowned “Swiss quality”

In such a demanding environment, conventional AI tools are not sufficient.

What’s needed is an AI Agent that not only complies with FADP/GDPR and internal policies, but also operates with audit-ready transparency and the service stability expected in Swiss healthcare systems.

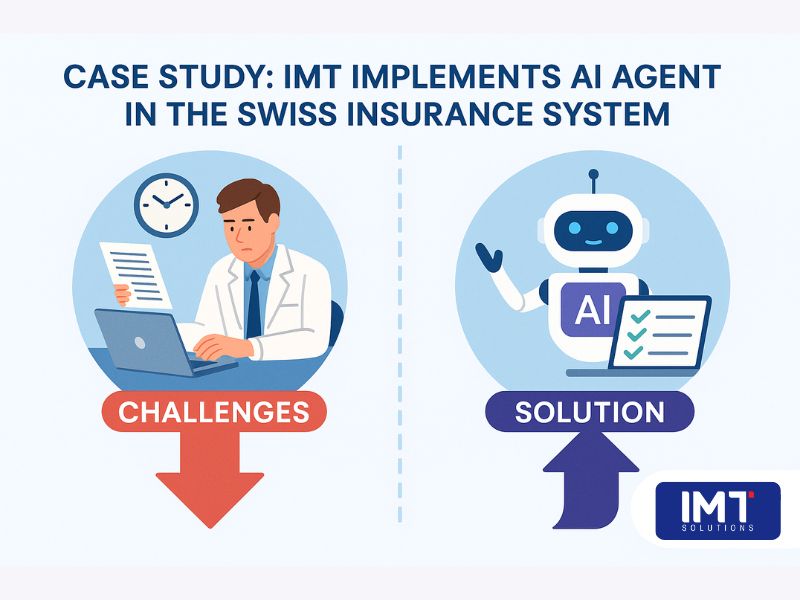

Case Study: IMT Implements AI Automate Insurance in Swiss Client’s Insurance System

An insurance company in Switzerland, working closely with healthcare providers and Third-Party Administrators (TPAs), was facing mounting pressure to streamline its medical guarantee approval process. Amid rising patient demands and increasingly complex healthcare data, the firm needed a scalable, compliant solution to eliminate processing delays and reduce operational strain.

Challenges: The 30-Minute Bottleneck in the Medical Guarantee Process

The partner’s TPA system in Switzerland faced:

- Bottlenecks at the benefit assessment and guarantee planning stages

- The process took ~30 minutes, hindering the workflow at the clinic

- The processing team had to manually handle complex medical records

- Unable to scale the number of requests per day without increasing personnel costs

Solution – AI Agent Automates the Entire Guarantee Processing Stage

IMT deployed an intelligent AI Agent, built to standards:

- Automatically assesses medical content using NLP (Natural Language Processing)

- Analyzes benefits, limits, and insurance terms using Machine Learning

- Automatically plans guarantees based on complex business rules

- Has the ability to control & trace (audit-ready) according to FADP standards

Processing time reduced from 25–30 minutes → only 2–3 minutes

Implementation Results at the Insurance Company:

Measurement Indicator |

Before Implementation |

After AI Agent Application |

|---|---|---|

| Processing Time for Requests | ~30 minutes | 2–3 minutes |

| Number of Requests/Day | Limited | Tripled |

| Operational Errors | Frequently Occurred | Significantly Reduced |

| Customer Satisfaction | Rate Average | Strongly Increased |

| FADP Compliance | Manual Processing | Automated & Audit-Ready |

Security & Compliance: An Indispensable Foundation in Switzerland

For these cases, Switzerland requires:

- All AI systems processing medical data must comply with the Swiss Data Protection Act (FADP). This law requires businesses to be transparent about how AI makes decisions and allows users the right to request a review if they disagree with the system’s decision (FDPIC, 2023).

- AI must be designed to ensure that personal information is always kept secure. In many cases, businesses must also conduct a Data Protection Impact Assessment (DPIA) before deploying the system (Guardos AI Guide, 2025).

- Additionally, systems need to have a mechanism to monitor AI activity to ensure that all decisions are recorded and can be reviewed when necessary (Mondaq, 2024).

Our AI Agent is designed to fully meet these requirements and can be integrated into the existing IT ecosystem of the insurance company. Compared to traditional enterprise AI platforms, our solution offers a more accessible cost model – optimized for both developed markets like Switzerland and growing markets like Vietnam, where cost-efficiency is a core decision factor. Our team has also worked extensively on healthcare workflow optimization, such as building a Health Information Management System serving nearly 4,000 clinics in Southeast Asia. In that project, the system was tailored to comply with fast-changing audit and data regulations – a core challenge also faced by insurance businesses today. These lessons in automation, compliance, and customer response have directly influenced the AI Agent’s current design – especially for environments requiring fast decision-making and end-to-end traceability. IMT’s AI Agent enables organizations to automate insurance data processing in a way that is both secure and auditable — a key differentiator in the Swiss healthcare market.

Results: Tangible Impact on Patient Experience & Process Efficiency

After implementing IMT’s AI Agent to automate insurance claim evaluation and guarantee planning, the client – a Swiss insurance firm working with multiple healthcare facilities and TPA units – experienced a significant transformation in operational efficiency. What once took up to 30 minutes per case was reduced to just under 3 minutes. This dramatic improvement enabled the client to handle a much higher volume of daily requests without increasing staffing costs – helping them scale efficiently while maintaining service quality. For their healthcare partners, wait times at hospital reception desks dropped sharply, easing congestion during peak hours and creating a smoother experience for patients – especially those relying on immediate outpatient insurance approvals. This faster coordination between clinics and insurers also reduced manual errors, improved treatment workflows, and strengthened the overall reputation of the client’s insurance services. Most importantly, the AI-driven automation helped elevate patient satisfaction, which translated into stronger customer loyalty and a more competitive position for the client in Switzerland’s high-standard insurance market.

Real-World Parallels from the Swiss Market:

- SWICA, a Swiss health insurer, introduced the Benecura digital platform to support medical record management and pre-assessment. The solution served 50,000+ customers and contributed to measurable improvements in customer satisfaction. SciTePress Case Study, 2024

- According to Swiss Re, digitalization across Switzerland’s health insurance sector could generate up to CHF 8.2 billion per year, largely through better patient experience, streamlined insurance approvals, and reduced administrative costs. Swiss Re Report, 2023

Conclusion: Speed + Security = Competitive Advantage in Switzerland

The AI Agent developed by IMT directly addresses the most pressing bottleneck in on-site insurance guarantees, cutting down processing time from 30 minutes to just 2–3 minutes. Beyond efficiency, the solution is fully compliant with FADP, GDPR, and internal auditing standards – ensuring transparency, data protection, and complete traceability across operations. Crucially, this AI Agent also upholds the level of service excellence expected in Swiss healthcare: delivering not only speed, but also precision, reliability, and a seamless experience for both patients and administrative staff. These advantages position insurance companies for long-term success in a highly competitive and quality-driven market like Switzerland. Moreover, the solution is scalable and adaptable for broader use cases across the insurance and financial sectors – including payments, claims review, consulting hotlines, credit scoring, loan processing, and customer support in banking environments – making it a future-ready investment for any forward-thinking organization. As the insurance sector faces rising expectations, the ability to automate insurance processes – while ensuring speed, transparency, and trust – will become a defining factor for long-term success in both developed and emerging markets.