Vietnam moved up to Top 05 in A.T. Kearney Outsourcing Location Report 2019

Vietnam moved up to Top 05 in A.T. Kearney Outsourcing Location Report 2019

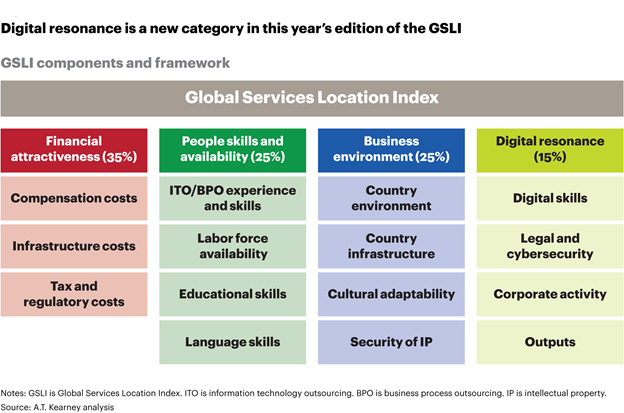

With the fast-growing application of automation technology, automation and cybersecurity are increasingly becoming key factors in any outsourcing decision. In GSLI 2019, A.T. Kearney has made significant change in its evaluation criteria to reflect the rapid shift of businesses to the digital era.

The report focuses on lower-cost countries that are taking the large market shares of the current global outsourcing market. The report however includes some higher-cost countries such as the United States, the United Kingdom, France, and Germany as the benchmarks for demand markets, other higher-cost countries such as South Korea and Japan are not included.

This year GSLI report reflects the rising impact of automation and security, A.T. Kearney added new evaluation category digital resonance, which has 4 following factors:

- Digital skills of the country’s workforce

- Legal and cybersecurity, meaning how the legal framework takes digital business models into account

- Corporate activity, defined as the amount of capital invested in start-ups and the number of deals by venture capitals (VC) in 2018

- Digital outputs including creative products, as well as knowledge and technology outputs

The figure 1 below illustrates the new evaluation framework revised to reflect the shift of businesses to the digital era.

This analysis was done for 50 offshore outsourcing countries across four major categories: financial attractiveness, people skills and availability, business environment, and digital resonance.

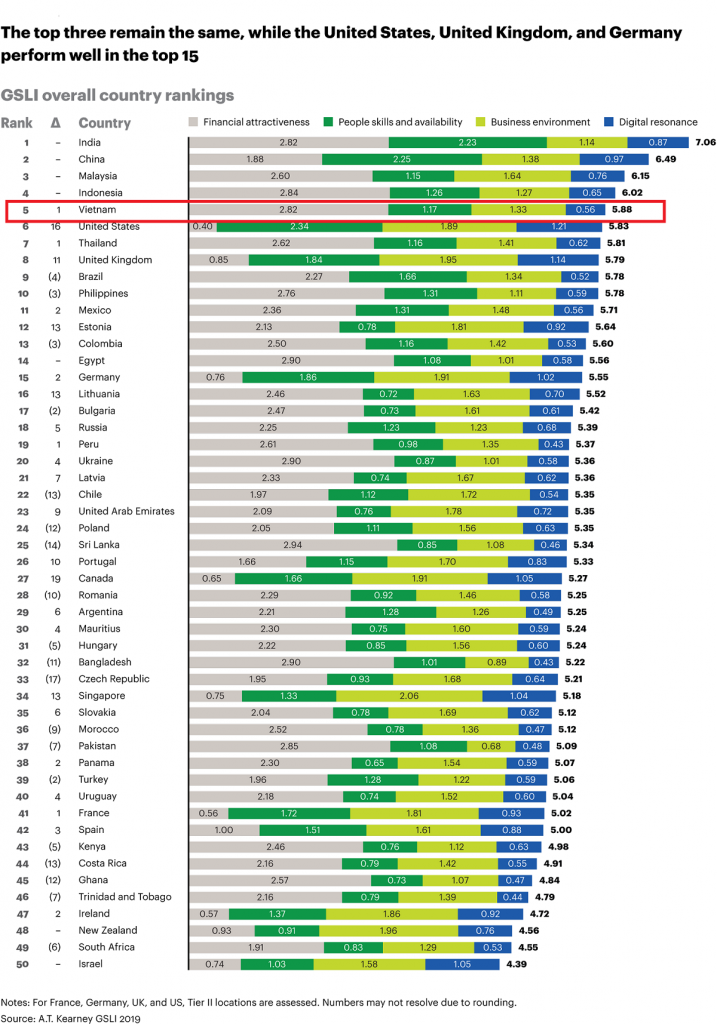

The GLSI index 2019 shows that the top 4 countries remain the same while countries like the United States, the United Kingdom and Germany have improved their ranking significantly. This is due to the strong scores in digital resonance of large and established players such as the United Kingdom, Canada, the United States, and Germany.

In this year report, Vietnam remains very attractive in term of cost with its sizable digital workforce pool available for the IT outsourcing and BPO. In general Vietnam was ranked number five (05) moving up one position since the last report. Vietnam had the third-largest increase in the business environment score, driven by a large score increase in the country infrastructure component, thanks to the action of the new leadership team who are emphasizing on startup and digital transformation. Foreign companies such as Intel, IBM, Samsung, LG, Nokia, and Microsoft continues to invest in Vietnam, showing a continued momentum for the ICT industry. Japanese IT companies are increasingly using offshore outsourcing services in Vietnam for ITO and BPO. The report indicates that Vietnam currently has over 20,000 employees working for Japanese companies in both offshore software development and business process outsourcing. Since year 2000, Japanese IT companies see Vietnam as the offshore outsourcing solution for their shortage labor force. Vietnam is seen as the attractive alternative to China thanks to its low cost, s large pool of skilled software engineers and the cultural similarity.

Vietnamese government is executing an aggressive plan to develop a more highly skilled workforce, and the country is dedicated to higher education and to fostering English and Japanese proficiency. English is taught as the foreign language since the elementary school. Japanese, French and German are also taught as foreign language in some junior high schools. Also in Vietnam there is a large community of Chinese people. This makes Vietnam a promising location in providing languages support services such as call center, contact center in Japanese, Chinese, English, French and German.

In Digital resonance criteria, Vietnam was ranked #37 with the score 3.72 due to its lower score in Corporate activity. In the last few years more and more investments are coming to Vietnam startups but in general the absolute value is still below that of other countries in the area such as Indonesia, Thailand and Philippines.

In Cybersecurity investment, Vietnam was grouped in the Nascent group, in the same group with India, China, Phillipe’s, Indonesia, Thailand, Mexico, Brazil, Poland and Russia.

In summary, Vietnam remain cost attractive with its large outsourcing worker pool, while the legal framework and cyber security investment are on the same group with other top outsourcing locations such as India or Indonesia.

Please refer to Figure 2 for detail ranking result GSLI 2019

More information about the Global Service Index Location report can be found at: https://www.atkearney.com/digital-transformation/gsli/2019-full-report

If you are interested in knowing more about Vietnam offshore outsourcing companies please visit https://vietnam-offshore.com/

Build your expert team at:

Website: https://www.imt-soft.com/

Linkedin: Visit IMT Solutions on Linkin

Facebook: Visit IMT Solutions on Facebook

Email: sales@imt-soft.com

Updated: July 3, 2019