Enhancing security with IT Outsourcing service

The insurance industry is currently facing significant security risks due to the handling of large volumes of sensitive data, including customers’ personal information, medical records, and financial details. This high-value data makes insurance companies attractive targets for cybercriminals. Cybersecurity in insurance is a growing concern, as security threats primarily stem from data breaches caused by human or system errors, targeted cyberattacks such as ransomware and phishing, as well as unpatched vulnerabilities in technological infrastructure. Without proper protective measures, insurance businesses may face severe consequences, including financial losses, reputational damage, and violations of data protection regulations. Ensuring data protection for insurance industry is crucial in mitigating these risks.

In fact, in recent times, many insurance companies have fallen victim to large-scale cyberattacks. These incidents not only expose customer information but also disrupt business operations and result in significant financial losses. For example, several major insurance firms have suffered ransomware attacks, leading to system lockdowns and data theft, forcing them to pay substantial ransom fees or risk having their data leaked. This highlights the critical importance of strengthening cybersecurity in insurance, investing in advanced security technologies, and raising employee awareness to safeguard businesses against the growing cyber threats. A strong focus on data protection for insurance industry is essential to combat these challenges.

Consequences of not having effective data protection solutions

Failing to implement effective data protection solutions can lead to severe consequences for insurance businesses, with financial losses being one of the most significant risks. When hackers infiltrate a system, they can steal or encrypt critical data and demand a substantial ransom to restore access. Additionally, the costs associated with system recovery, investigating the breach, and mitigating the damage can consume considerable resources. Companies may also be required to compensate affected customers, further straining their financial stability. Ensuring robust insurance data security and data protection for insurance industry is vital to preventing such costly incidents.

Beyond financial losses, data breaches can severely damage a company’s reputation. When customer information is exposed, trust in the business diminishes, making clients hesitant to continue using its services. According to various studies, customer churn rates tend to rise significantly after a security incident due to loss of confidence. This not only results in declining revenue but also weakens the company’s competitive edge, especially in an industry where customers have multiple alternatives. Implementing remote employee tracking and data leak prevention strategies can help mitigate these risks and maintain a strong security posture. Prioritizing data protection for insurance industry ensures business continuity and competitive advantage.

Furthermore, insurance companies must navigate legal risks if they fail to comply with data protection regulations. Laws such as GDPR, PCI DSS, and local data protection policies impose strict requirements on managing and securing customer information. Non-compliance can lead to substantial fines or even legal liabilities, which can have long-term impacts on business operations. Data security in smart technology ensures compliance with these regulations while enhancing the overall security framework. Therefore, investing in robust security systems and ensuring strict adherence to regulatory requirements is essential to safeguarding businesses from these serious consequences. Data protection for insurance industry should be a core priority in any security strategy.

IT Outsourcing (ITO) – The optimal solution for Insurance data security

IT Outsourcing (ITO) is the optimal solution for insurance companies to enhance data security against increasingly sophisticated cyber threats. ITO providers like IMT Solutions offer advanced security systems with cutting-edge encryption measures, ensuring comprehensive data protection. Additionally, real-time security monitoring systems can detect and prevent cyberattacks at an early stage, helping businesses mitigate the risks of data breaches and financial losses. Cybersecurity in insurance can be significantly improved by leveraging the expertise and infrastructure of specialized ITO providers. By integrating data protection for insurance industry into outsourcing strategies, businesses can strengthen their security frameworks.

Beyond strengthening security, IT Outsourcing also helps insurance companies reduce workload and optimize operational costs. Instead of maintaining a large in-house cybersecurity team, businesses can focus on their core operations while ITO providers take full responsibility for system’s security and infrastructure. Notably, IMT Solutions utilizes proprietary software development and self-hosted deployment systems, without reliance on third-party hosting. This ensures the highest level of data security for both customers and internal operations, reinforcing the importance of insurance data security. Partnering with a reliable ITO provider enhances data protection for insurance industry and ensures long-term stability.

Furthermore, ITO services enable insurance companies to comply strictly with international security regulations. The systems and processes implemented by ITO providers adhere to the latest standards, such as GDPR, PCI DSS, and local data protection regulations. This not only minimizes the risk of regulatory fines but also strengthens customer and partner trust. Additionally, implementing remote employee tracking and data leak prevention mechanisms within IT outsourcing services ensures end-to-end security. With these comprehensive benefits, IT Outsourcing emerges as the optimal solution for insurance companies to safeguard their data in the digital age. The role of data protection for insurance industry in IT outsourcing cannot be overstated.

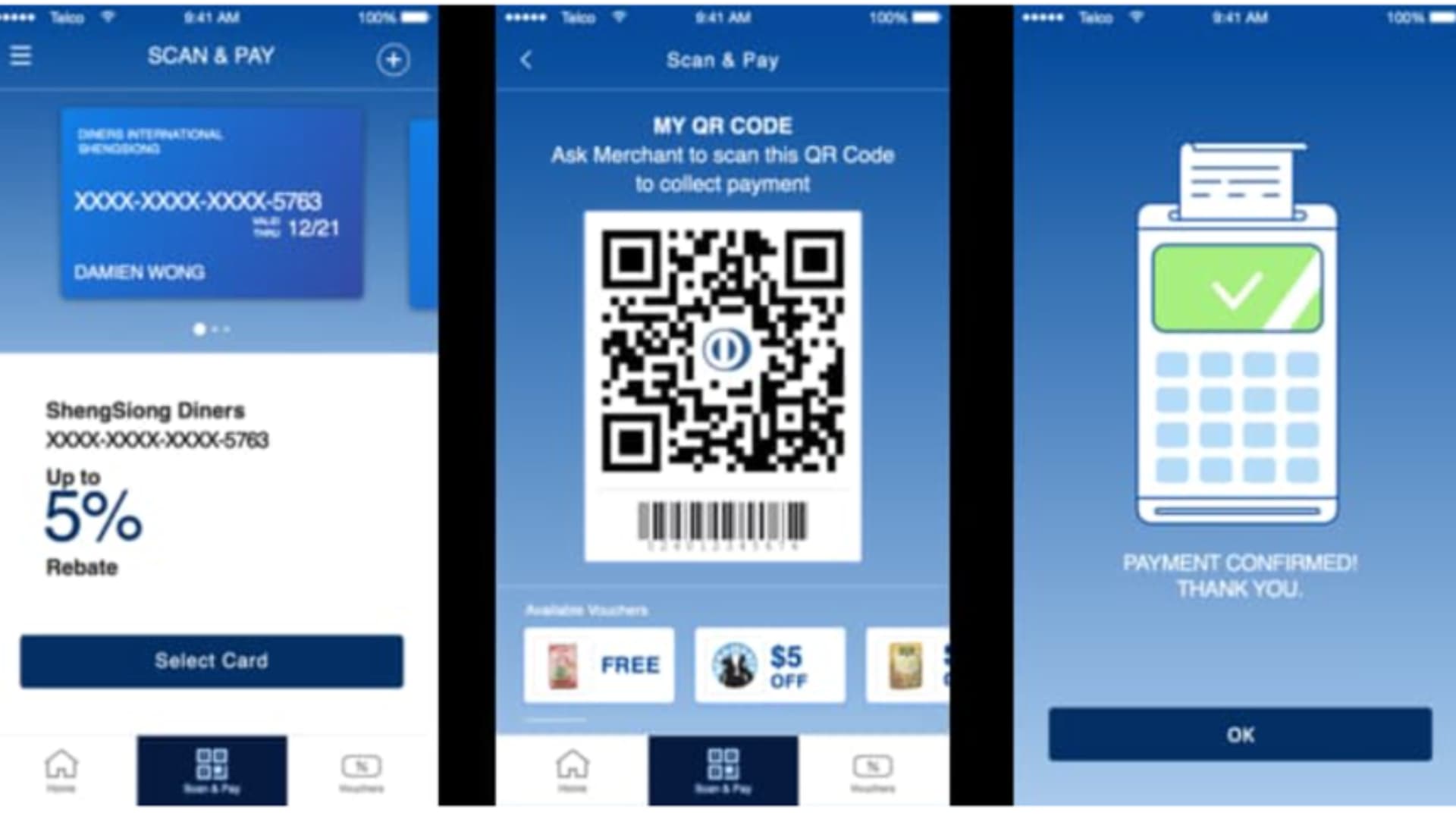

Success Story: Epayment solution for for US market partners

IMT Solutions has partnered with leading businesses in the electronic payment industry to develop a powerful, intuitive, and user-friendly cashless mobile payment application. This integrated platform simplifies transactions, enhances user experience, and provides valuable customer data insights. Importantly, it incorporates advanced measures for data security in smart technology, ensuring the safe processing and storage of sensitive information. The inclusion of cybersecurity in insurance within financial technology applications enhances overall security and reliability. Strong data protection for insurance industry is critical in financial technology applications.

The application has delivered significant benefits, including a 20% reduction in workforce requirements, a 10% revenue increase due to improved efficiency, and a 15% boost in customer acquisition rates. Faster product launch cycles and superior software quality further reinforced its value. Emphasizing data security in smart technology has also strengthened customer trust, making it a standout solution in a competitive market. Prioritizing data protection for insurance industry in financial applications enhances security and business resilience.

Outsourcing IT services to IMT Solutions has enabled businesses to optimize operations, reduce costs, and accelerate growth. This case highlights the strategic advantage of outsourcing IT services in Vietnam as an effective approach for business expansion and long-term success. Insurance data security remains a top priority for businesses looking to stay competitive while ensuring customer trust and regulatory compliance. Businesses that integrate data protection for insurance industry into their IT outsourcing strategies can achieve sustainable growth.

In the face of increasing cybersecurity threats, insurance companies are at risk of data breaches, financial losses, and reputational damage if they do not implement effective security measures. Given the vast amount of sensitive data they handle, even a single security breach can have severe consequences, undermining customer trust and regulatory compliance. Therefore, investing in comprehensive security solutions, including cybersecurity in insurance and remote employee tracking and data leak prevention, is not just an option but a necessity to protect businesses from potential risks. Ensuring data protection for insurance industry is essential for long-term security and compliance.

ITO is a strategic investment solution that helps insurance companies enhance security while optimizing operational costs. Instead of building and maintaining a complex in-house IT system, businesses can collaborate with experienced ITO providers like IMT Solutions, which offers a strong infrastructure and comprehensive security solutions. Choosing the right ITO partner not only ensures effective data protection but also delivers high ROI rates, allowing companies to focus on their core values and achieve sustainable growth. Ensuring data security in smart technology is a key factor in maintaining a competitive edge in the modern digital landscape. Data protection for insurance industry remains a critical component of business success.