Top Popular Invoice Management Software

Invoice management software is essential for modern businesses looking to streamline their financial processes. These tools help companies track, process, and store invoices efficiently, reducing errors and ensuring compliance with legal regulations. In this article, we will explore the top four popular invoice management software solutions, their key features, advantages and disadvantages, user suitability, and pricing. By understanding these software options, businesses can make informed decisions to optimize their financial operations.

What is Invoice management software?

Invoice management software consists of technological tools designed to help businesses track, process, and store invoices. The use of this software helps optimize financial processes, minimize errors, and ensure compliance with legal regulations.

Read How IT outsourcing service can reduce manual invoice processing errors

Xero-Invoice-Management-Software-Suitable-Medium-and-Small-Companies

Introduction to Xero

Xero is a cloud-based financial and accounting management software designed specifically for small and medium-sized businesses. This software is renowned for its user-friendly interface and ease of use, helping businesses effortlessly manage their daily financial activities.

Purpose and Key Features

Invoice management software Xero aims to provide a comprehensive solution for financial management, helping businesses automate and optimize their accounting and invoicing processes. The standout features of Xero include:

- Automatic Invoice Creation and Sending: Xero allows for the automatic creation and sending of invoices to customers. Businesses can set up recurring invoices and send them automatically at the scheduled time.

- Payment Tracking: Supports tracking the payment status of invoices, helping businesses manage accounts receivable effectively. Xero can automatically send payment reminders to customers.

- Bank Integration: Xero integrates with multiple banks, enabling businesses to easily track bank transactions and automatically reconcile them with invoices.

- Detailed Financial Reporting: Helps businesses monitor their financial status and make accurate business decisions. Reports can be customized to meet the specific needs of the business.

Pros and Cons of Invoice Management Software Xero

Pros |

Cons |

|---|---|

| User-friendly interface and easy to use for beginners. | entering 5 bills per month, restrictive for businesses needing to process a large number of invoices. |

| Automation of invoice creation and sending, expense management, and bank transaction reconciliation, saves time. | No phone support, users must create online support requests and wait for responses. |

| Integration with multiple banks automatically uploads and reconciles bank transactions. | Advanced features such as multi-currency management, project tracking, and financial analysis. Only available in higher-priced plans, increasing the overall cost. |

| Provides detailed and customizable financial reports, helps monitor financial status, and makes accurate business decisions. | Don’t meet the complex needs of larger businesses with extensive financial management requirements. |

| Supports management of transactions in multiple currencies, suitable for businesses operating internationally. | |

| Automatic recording and secure storage of invoices and receipts on the cloud platform, easily retrievable when needed. | |

| Offers a 30-day free trial, allowing users to experience the full range of features before deciding to purchase. |

Target Audience of Invoice Management software Xero

Xero is suitable for small to medium-sized businesses and startups looking to optimize their financial and accounting processes effectively. It is ideal for businesses needing to manage invoices, accounts receivable, and daily financial transactions automatically and accurately. However, Xero may not be suitable for large enterprises with more complex financial management needs that may require more comprehensive and robust integrated solutions.

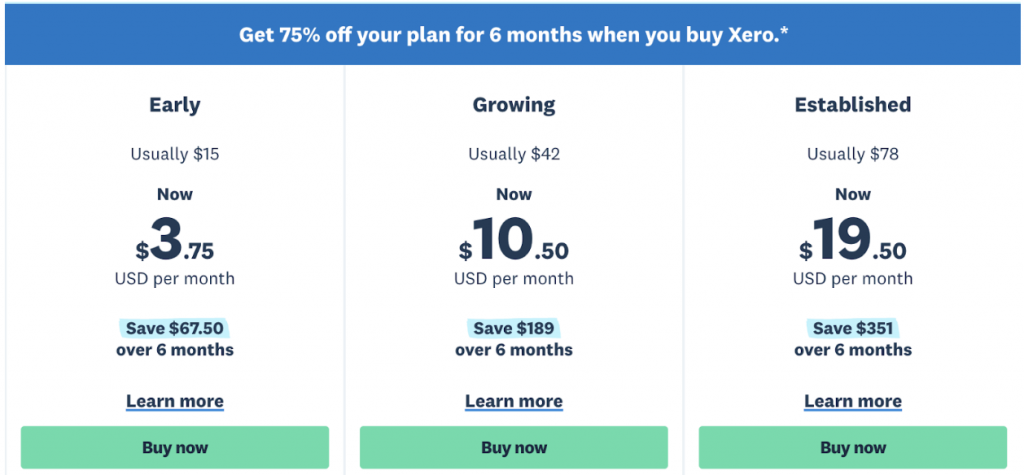

Pricing

Price/Month |

Features |

|

|---|---|---|

| Early Plan | $3.75 |

|

| Growing Plan | $10.50 |

|

| Established Plan | $19.50 |

|

QuickBooks – Invoice Management Software Suitable All Company

Introduction to QuickBooks

QuickBooks is a comprehensive accounting software developed by Intuit, renowned for its powerful features and flexible adaptability for both small and large businesses. This software is designed to help businesses manage their finances, invoices, and accounting activities efficiently and easily.

Purpose and Key Features

Invoice management software QuickBooks aims to provide a comprehensive accounting solution for businesses, helping manage finances effectively and automating many accounting processes. The key features of QuickBooks include:

- Invoice Management: Allows for the easy creation, sending, receiving, and storing of invoices. QuickBooks also supports creating recurring invoices and payment reminders.

- Expense and Accounts Receivable Tracking: Manages incurred expenses and accounts receivable in detail, helping businesses monitor their financial status.

- Financial Reporting: Provides detailed and customizable financial reports, helping businesses evaluate their financial situation and make accurate decisions.

- Bank Integration: Integrates with multiple banks, allowing for automatic downloading and reconciliation of bank transactions.

- Payroll Management: Supports the calculation and management of employee payroll, including tax and insurance processing.

- Project Tracking: Enables tracking of costs and revenues by project, helping manage and assess the effectiveness of business projects.

Pros and Cons of Invoice Management software QuickBooks

Pros |

Cons |

|---|---|

| Provides comprehensive accounting features, ranging from invoice management and expense tracking to payroll and project management. | High cost, especially for advanced features and larger businesses. |

| User-friendly interface, intuitive and easy to use, suitable for users without an accounting background. | Complex features may require a learning curve. Users might need time to learn and get accustomed to the software. |

| Integration with multiple banks and applications helps automate and simplify the accounting process. | Customer support issues, some users report that technical support is not always timely or effective. |

| Powerful reporting and analytical tools, helps businesses monitor and optimize their financial performance. | Doesn’t fully meet the complex needs of large enterprises: May fall short for large businesses with extensive financial management requirements. |

Target Audience

Invoice management software QuickBooks is suitable for small, medium, and large businesses seeking a comprehensive accounting solution. This software is ideal for companies that need to manage invoices, expenses, accounts receivable, payroll, and projects. It is not suitable for very small businesses or individuals who do not require complex accounting features. Users looking for a simpler and more affordable accounting solution may not need the extensive features of QuickBooks.

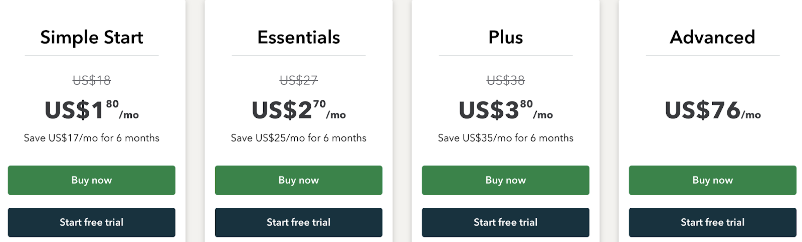

Pricing

Price/Month |

Features |

|

|---|---|---|

| Simple Start | $1.8 |

|

| Essentials | $2.7 |

|

| Plus | $3.8 |

|

| Advanced | $76 |

|

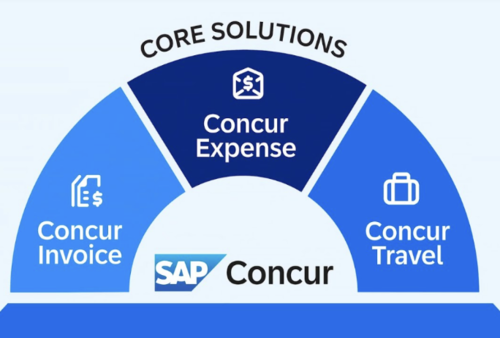

SAP Concur – Invoice Management Software Suitable for Large Company

Introduction invoice management software SAP Concur

SAP Concur is a cloud-based expense and invoice management software, designed specifically for large enterprises. This software helps businesses manage complex financial processes efficiently and automates tasks from invoice management to expense tracking and financial reporting. SAP Concur is one of the leading solutions trusted by many large companies worldwide.

Purpose and Key Features

SAP Concur is developed to provide a comprehensive solution for financial management, helping businesses automate and optimize expense and invoice management processes. The key features of SAP Concur include:

- Electronic Invoice Management: Supports the management and storage of electronic invoices, helping to reduce processing time and ensure accuracy.

- ERP System Integration: Easily integrates with other ERP systems, facilitating data synchronization and optimizing financial processes.

- Expense Management: Supports both personal and corporate expense management, from travel expenses to other business costs, helping to effectively control budgets.

- Reporting and Analytics: Provide detailed reporting and analytics tools, helping businesses monitor and forecast financial conditions, thereby making accurate business decisions.

- Process Automation: Automates approval processes for expenses and invoices, reducing manual work and enhancing operational efficiency.

Pros and Cons of SAP Concur

Pros |

Cons |

|---|---|

| Helps automate invoice and expense management processes, reducing errors and saving time. | SAP Concur has high implementation and maintenance costs, making it more suitable for large enterprises with substantial budgets. |

| Easily integrates with ERP systems and other financial tools, optimizing financial management processes. | Requires time and resources to implement and train staff to use the software effectively. |

| Provides detailed reports and analytics, helping businesses monitor financial status and forecast trends. | Requires complex systems and technological infrastructure to integrate and operate efficiently. |

| Supports management of all types of expenses, from travel to other business costs, effectively controlling budgets. | |

| Suitable for businesses operating internationally, supporting multiple languages and currencies. |

Target Audience of Invoice management software SAP Concur

SAP Concur is suitable for various user groups, but primarily large enterprises and multinational corporations that require a comprehensive and robust solution for managing expenses and invoices. It is ideal for businesses needing integration with ERP systems and managing complex financial operations. It is not suitable for small and medium-sized enterprises with limited budgets and no need for complex financial management.

Pricing

The pricing of invoice management software SAP Concur depends on the size of the business and the features chosen. Typically, costs include an initial setup fee and ongoing monthly or annual maintenance fees. Due to its high cost and rich features, SAP Concur usually requires direct contact for a detailed and customized quote based on specific business needs. SAP Concur also offers trial versions and demos for businesses to experience the software before making a purchase decision.

Selecting the right invoice management software can significantly impact a business’s efficiency and financial accuracy. Xero, QuickBooks, SAP Concur, and the other highlighted tools each offer unique features and benefits tailored to different business needs. Xero and QuickBooks provide robust solutions for small to medium-sized enterprises, while SAP Concur caters to the complex requirements of large corporations with its comprehensive expense management capabilities. Understanding the specific needs of your business and comparing these options will help you choose the best software to enhance your financial management processes.