Online Payment to Customer Behavior: A Dual Approach to Revenue Growth

The Convenience of Online Payment in the Digital Age

In today’s fast-paced world, businesses are grappling with the increasing demand for swift and effortless payment methods. Consumers are using online payment methods to pay for things more and more. It’s becoming a hassle to carry cash around, and businesses that only accept cash or traditional card payments risk losing customers. People want to pay quickly and easily, and this is becoming more important than ever.

According to a report by Clearly Payments, people will make digital payments worth about US$9.46 trillion in 2023. This shows how many people are starting to prefer digital payments. Also, according to Statista, about half of all online shopping payments in 2022 were made with mobile wallets. This means people are not just ready for digital payments, but are actively using them for their daily shopping. In 2021, 82 percent of the US’s residents were using digital payments, which is more than the previous year’s 78 percent and the 72 percent from five years ago. This increase shows that more and more people prefer online payments.

The Cost of Sticking to Traditional Payment Methods in the Age of Online Payment

In our rapidly evolving digital age, businesses that solely rely on cash or traditional card payments are finding themselves on shaky ground. As the world becomes increasingly interconnected, digital wallets and online payments are not just conveniences, but necessities. They are the new norm, shaping the way consumers interact with businesses.

Sticking to traditional payment methods in such a dynamic environment could have serious implications. Without an online payment option, checkout lines can become longer, leading to customer frustration and potentially lower sales. In essence, failing to adapt to online payment methods could cost businesses their customer base and impact their profitability. The pressing question for businesses today is, “How can businesses navigate these challenges and successfully integrate online payments into their operations to remain competitive and relevant in the market?”

The Hidden Challenges of Not Going Cashless in the Online Payment Era

In the digital age, the absence of a cashless payment system can present a multitude of challenges for both customers and businesses.

ON THE CUSTOMER SIDE

From a customer’s perspective, the need to carry physical cash or cards can be a significant inconvenience. It’s not just about the physical burden of carrying around coins and notes or multiple plastic cards. There’s also the mental load of remembering to withdraw cash, worrying about running out of money, and dealing with loose change.

Moreover, carrying cash comes with security risks. It increases the likelihood of theft or loss. Without a secure mobile payment solution, customers’ financial security could be compromised. They may worry about losing their wallet or having it stolen, which could lead to unauthorized access to their funds.

ON THE BUSINESS SIDE

On the business side, vendors face their own set of challenges when they don’t offer mobile payment options. One major issue is the lack of valuable insights into customer behaviors. Without data from mobile payments, it’s difficult for businesses to understand their customers’ purchasing habits, preferences, and patterns. This makes it challenging to tailor their marketing strategies effectively and meet customer needs.

Additionally, businesses without a mobile payment option could experience longer queues at checkout counters. This is not just an operational inefficiency; it directly impacts the customer experience. Longer wait times can lead to customer frustration, negatively affecting their overall shopping experience. In the long run, this could lead to a decline in customer satisfaction and loyalty, ultimately impacting sales.

Furthermore, businesses that do not adopt online payment systems may find themselves at a competitive disadvantage as they may not be able to keep up with the changing consumer preferences and technological advancements.

IMT’s Ability to Create Transformative Digital Solutions: Pioneering in Online Payment Systems

At IMT Solutions, we deeply understand the challenges that consumers and businesses face in a world without a cashless payment system. The inconvenience of carrying physical cash or cards for consumers, and the operational inefficiencies for businesses not offering mobile payment options, are significant.

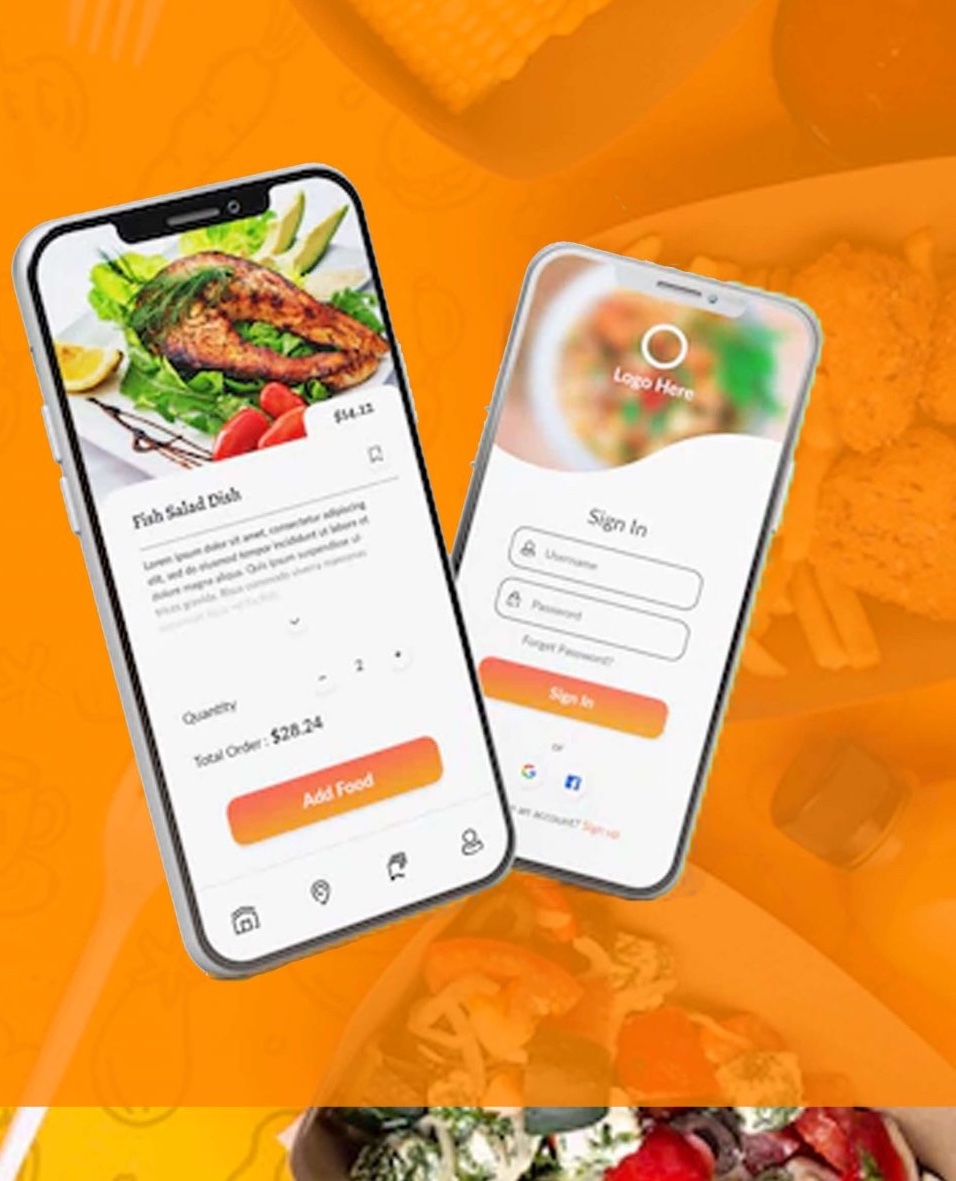

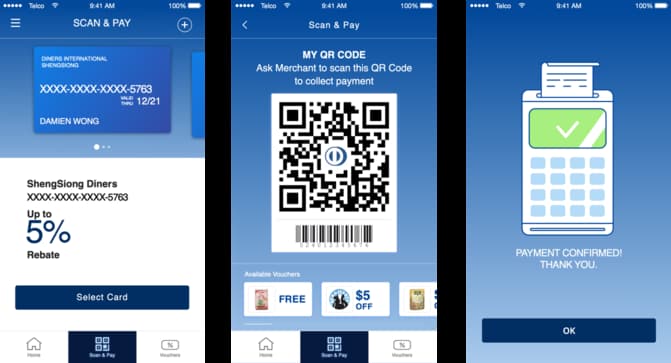

To tackle these challenges, IMT Solutions leverages its expertise to offer a robust and user-friendly Cashless Mobile Payment Application. This application is more than just a tool; it’s a comprehensive solution that streamlines transactions and provides valuable customer data. With this, businesses can enhance customer satisfaction, boost sales, and make data-driven marketing decisions.

HIGH TRANSACTION RATE

IMT’s ability to design applications that can handle up to 10,000 transactions per second ensures smooth operation even during peak business hours. Customers can enjoy a smoother shopping experience without having to wait in long queues at checkout counters.

ZERO RECOVERY POINT OBJECTIVE (RPO)

Our app ensures no data loss in the event of a system failure, safeguarding all transaction data. This feature safeguards all transaction data, providing businesses with the assurance that their data is safe.

FAST RECOVERY TIME OBJECTIVE (RTO)

Our app can be quickly restored to its pre-failure state in the event of a system failure, minimizing downtime and ensuring smooth business operations.

REAL-TIME ANALYTICS

Our application provides real-time analytics, enabling businesses to gain valuable insights into customer behaviors and preferences. This data can inform marketing decisions and help tailor services to meet customer needs.

MICROSERVICES ARCHITECTURE

Each function of our application is developed as an independent service, making the application more scalable and easier to maintain. It also facilitates continuous delivery and deployment of large, complex applications.

MASA READINESS

Our app is designed with MASA, or Mesh App and Service Architecture, in mind. This architectural style, which allows for multiple applications and services to work together in a flexible, dynamic environment, is a testament to IMT’s ability to create adaptable and integrated solutions. This feature enables businesses to seamlessly integrate our app with other services and applications, enhancing the customer experience.

Wrapping up, the proficiency of IMT in crafting Cashless Mobile Payment Applications presents businesses with an all-encompassing solution that is apt for the digital era. The high transaction speed, zero RPO, quick RTO, real-time analytics, microservices architecture, and MASA readiness are key features that equip businesses with the competitive edge they need to excel in today’s market

Results and Impact of Implementing Online Payment Systems

The Cashless Mobile Payment Application offers several benefits to businesses, including the potential to:

- Potentially reduce your workforce by up to 20%, leading to significant cost savings.

- Vendors can better understand customer behaviors and tailor their marketing strategies accordingly. This could lead to an anticipated rise in revenue by up to 10%.

- Potentially increasing customer acquisition rates by 15%.

- Increase customer retention rates by up to 25%.